Onramp Funds Review 2025 → World's Best eCommerce Lending Platform

Table of contents

- About Onramp Funds

- Overview of Onramp Funds

- Onramp Funds Review

- Onramp Funds Service Reviews

- How Onramp Funds Works

- Who Is Onramp Funds For?

- Onramp Funds Reviews: What Do Customers Think?

- Is Onramp Funds Legit?

- Is Onramp Funds Worth It?

- How To Contact Onramp Funds

- Where to buy Onramp Funds?

- Who owns Onramp Funds?

- What do you need to qualify for funding?

- Conclusion of Onramp Funds reviews

About Onramp Funds

Are you ready to take your business to the next level? In fact, running an eCommerce business is a challenging undertaking. Since the global pandemic, the market has changed rapidly with a drastic economic downturn. Fortunately, Onramp Funds is here to achieve your business to a better future.

The company is the world’s best eCommerce lending platform with a burning passion. But, more than that, they have deep expertise in eCommerce, finance, and software development. Specifically, the company provides quick cash solutions and resources to boost your business.

Onramp Funds has become a cash solution that is easily accessible and quick to respond to the ups and downs of your business. They uniquely protect your margins while enabling your growth.

In addition, they give access to capital to scale your business, purchase inventory, reduce supply chain costs, and even improve marketing.

Therefore, Onramp works with top digital marketing and advertising agencies such as Simplitic, Fancy Awesome, Flowium, Deog, Emotive, and many more to help eCommerce merchants increase sales and improve their brand’s digital footprint.

Furthermore, the company also partners with a list of eCommerce tools and agencies such as Ecomm Partnership, Cartology, Xapix, Shipbob, ChannelAdvisor, DeckCommerce, and many others to help more businesses achieve scalable, sustainable, and exponential growth.

Are you getting curious about this company? So, stay with Onramp Funds review because we’ll take you to all the information you want to know, including how they work, whether they are trusted, and so on.

Overview of Onramp Funds

As a new company in the financial services industry, Onramp Funds, established in 2020 by Eric Youngstrom, is a crucial platform in helping eCommerce.

They became an innovative financing platform that is a financial solution that funds working capital needs, freeing up your existing capital to invest in growth. In addition, with Onramp, you don’t have to pay for inventory until you receive sales deposits!

Headquartered in Austin, Texas, Onramp’s team understands eCommerce merchants’ unique challenges.

The team has 40 years of experience in empowering small eCommerce businesses, bringing a dedication to giving SMEs the cash they need when they need it to grow and scale their business. Want to join the team? Please go to the careers page for details.

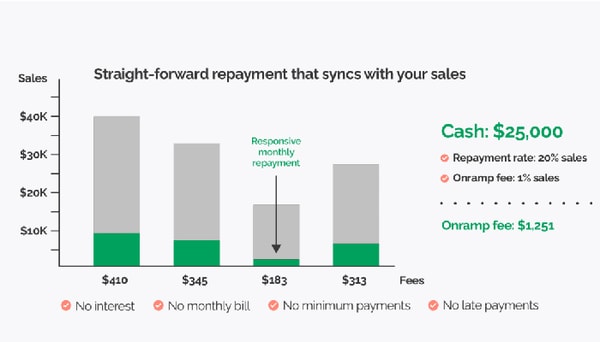

Unlike loan and credit card businesses with accrued interest and minimum payments, this company automatically takes about 1% of GMV. So you don’t have to worry about the big risks you have to take.

Here we have summarized the pros and cons of Onramp Funds in a few points below:

Pros

- Quick access to cash, low fees, and flexible payments to protect your margins

- No monthly bills, minimum payments, or late payment limits

- Fees are just 1% of sales

- Using industry-standard authentication, prevention, monitoring, and alerting tools

- BBB Rating & Accreditation

- Offer schedule a call

- Outstanding advisor team

Cons

- No information on the extent of file checking on e-commerce accounts

Onramp Funds Review

It’s a shame that everything in life costs money, isn’t it? Including setting up and running an eCommerce. Don’t let growth and cash flow management mess up your business journey.

With the presence of Onramp Funds, you will get a financial solution to fund your working capital needs. So, if you need cash to expand inventory, accelerate several other growth activities, and invest in marketing, Onramp is the solution!

Based on that, the company offers Quick access to cash, Low fees, and Flexible payments to protect your margins. As a result, success is aligned with your business performance in a very easy way.

So, let’s explore how this company works. Are you ready?

Onramp Funds Service Reviews

The company will determine your offer by looking at your sales history, not using your credit. They can also pre-qualify you within minutes with ZERO obligation. Either way, the company can see how much money you can get before you commit to anything.

Whereas to conduct due persistence and determine your eligibility for financing, companies need Read Only access to your eCommerce store. It provides access to fulfillment services, inventory, orders, product listings, location, and accounts payable.

This is intended to allow Onramp to view your store files and open and read them to prevent deletion, editing, overwriting, renaming, or other changes. However, there’s no need to worry as this restricts any writing to the files. So, the data will remain unchanged and safe.

In addition, as we mentioned earlier, this loan is different from any other credit. So, there is no interest that you need to pay forever! Moreover, the rates are also very low, with an estimated APR equivalent to 11.9% – 19.9%, depending on the terms of each advance. Best part? If you’re having a bad sales month, you can simply pay this service back as your business picks up!

As the company specifically aims to solve eCommerce businesses that often face cash flow problems by providing quick assistance, the brand usually approves online sellers for funding in just 24 to 72 hours. However, it usually takes less than one business day for each of your subsequent funding events to get approval.

They connect directly to Shopify, Amazon, Big Commerce Store, or Woo Commerce via a read-only API, streamlining the approval process and ensuring you get as much cash as possible and as quickly as possible.

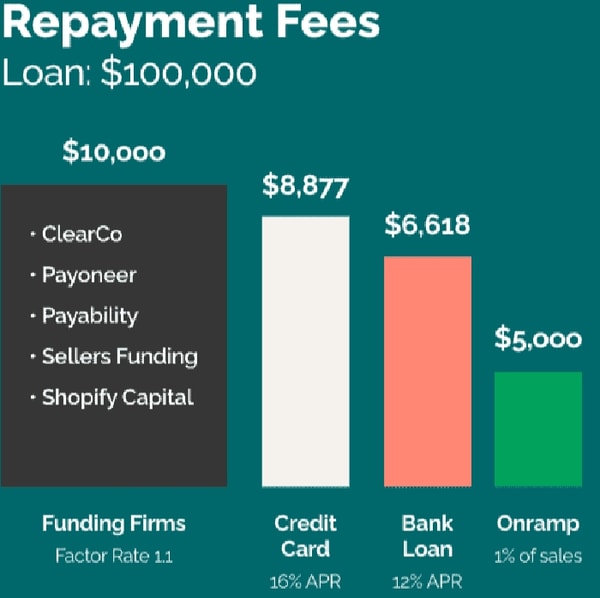

Also, there are no set fees. You only pay for this service when you sell your inventory. Thus, for every item you sell, the company automatically takes a small fee that is, on average, 50% lower than banks and funding tools. You will never even experience getting a bill. So you don’t have to worry about late, interest, or minimum payments.

How Onramp Funds Works

How does Onramp funding work? First, onramp syncs with your store via a read-only API, so they automatically take a small fee, on average, 50% lower than banks and other funding tools on every item you sell.

The company uniquely protects your margins while enabling your growth. Thus, you will find that getting the cash you need to maintain your inventory and grow your business is a breeze.

Here are 6 Onramp Funds easy steps:

- Create an account for easy login

- Integrate your store

- Prequalify

- Connect with banks

- Get cash

- Pay as you sell

Who Is Onramp Funds For?

Onramp Funds only works with eCommerce sellers, so you won’t get it if you’re not an eCommerce seller! Also, this company will help those needing working capital investment in sales growth.

Besides, since the company connects directly with several retail companies such as Shopify, Amazon, Walmart, SquareSpace, BigCommerce, or WooCommerce, you who sell in these places will get flexible working capital.

Onramp Funds Reviews: What Do Customers Think?

Although it is a new company in the financial services industry, Onramp Funds has gotten some reviews from customers who have tried its services. Although the number may be small, Onramp Funds reviews find that customers give a fairly high rating with positive reviews.

We found the company to have a rating of 4.4/5 from 64 total reviewers on the Trustpilot website. In addition, we also found the company to have a rating of 4.1/5 from 17 reviews on Google. So, let’s go with the reviews:

Highly informative and easy to engage with. They were helpful when I had difficulties, and their program seemed to be solid and simple to integrate with my existing Shopify store…

According to the customer’s experience above, the company helped him with a program that was easy to integrate with his Shopify store. It was good cooperation, easy, and very informative for him.

Another customer said:

Onramp made the funding process easy and fast. Morgan contacted us very quickly after we created our account and was very helpful in getting us started with their process… Onramp made us feel that they really care about the success of our business.

The customer was satisfied with the quick and easy funding process. Moreover, the team was very quick to help her after she created the account, giving her more value.

The last review came from the founder and owner of Kindfolk Yoga, who was delighted with the company’s help and left a comment:

Onramp offered a flawless solution with revenue-based financing to help secure the capital we needed to invest in inventory and pay it back within a reasonable timeframe once we made the sale. The process was easy, fast, and the support was amazing.

The yoga business owner seemed satisfied with the company’s excellent services and solutions. In addition, the quick and easy process made it a perfect rate.

Overall, from the three reviews above, it makes us think that it is natural that Onramp Funds, a new company, gets quite high customer scores. Its easy and fast process gives a lot of satisfaction to its customers. Besides the process, its outstanding customer service team has a significant impact.

Is Onramp Funds Legit?

It’s reasonable that you check the legitimacy of a company before entrusting your business to its services. Therefore, in this section, we will discuss it. Moreover, Onramp Funds is brand new to the industry, so you must check if they are a legitimate company.

The company uses industry-standard authentication, prevention, monitoring, and alerting tools to conform to Open Web Application Security Project (OWASP) standards. They also try to avoid capturing PII customer data to limit potential exposure to data breaches and focus only on high-level sales performance data.

After searching for related information, we found that this company has BBB Rating & Accreditation with a score of A. In addition, the Linkedin account has clear information about when the brand was established, who the owner is, and their locations.

They also list the team behind the company on the official website. Thus, it is enough to prove that Onramp Funds is legit.

Is Onramp Funds Worth It?

When you choose Onramp, you choose more than just a cash solution. Onramp Funds is a financial services company worthy of your e-commerce success journey. With this company, you can reduce financial risk while growing your business.

This company is different if loan and credit card businesses use accrual interest and minimum payments. Onramp automatically takes about 1% of GMV. So, you don’t have to worry about major risks to your business.

They offer a wide range of benefits to be a fast and accessible cash solution, including quick access to cash, low fees, and flexible payments to protect your margins.

Moreover, there are no monthly bills, minimum payments, or late payment limits, just peace of mind in running your e-commerce business!

How To Contact Onramp Funds

Onramp Funds is here to partner with its customers and not just a tool. It is an honor for them to be part of your team.

So, whatever your problems, you can start talking to an advisor to start your business success journey. They offer Schedule a call divided into 3 parts according to your goals. Or, you can speak to the customer service team at (855) 232-8515 between 8 AM–6 PM CST.

Alternatively, you can send your message via email to [email protected] or [email protected] to get answers to your questions.

Where to buy Onramp Funds?

Where to access this service? Currently, the brand doesn’t have an application you can access to get its services. So, the only place to access its services is through its official website at www.onrampfunds.com. Access is easy, which we have listed in the How Onramp Funds Works section.

Onramp Funds Frequently asked questions (FAQ)

When looking for Onramp Funds reviews, customers typically ask the following questions. we provide the answers to help you in making a smart purchase decision.

Who owns Onramp Funds?

So, the founder and CEO of Onramp Funds, Inc is Eric Youngstrom.

What do you need to qualify for funding?

So, to fulfill the loan confirmation, the requirements are you need an online sales history of usually more than 6 to 12 months with products with a proven sales history and inventory turnover.

Conclusion of Onramp Funds reviews & ratings

Taking out a loan to boost your e-commerce business isn’t easy, but with Onramp Funds, you get the best solution for what you need. This company is here to help you grow your e-commerce until you succeed with a simple and fast process.

No monthly bills, minimum payments, or late payment limits. Now all the convenience is in your hands!

Disclaimer

We're reader-supported. Oh, and FYI When you buy through links on our site, we may earn an affiliate commission from the links on this page.